Payment Hub

Pay online or by check. Stay on top of your mortgage without stress.

Managing Your Mortgage Payments Just Got Easier

At Newrez, we understand that managing mortgage payments can sometimes feel overwhelming, especially when balancing other financial responsibilities. That’s why we’ve introduced flexible payment options designed to make staying on top of your mortgage simple, convenient, and aligned with your lifestyle. From automatic withdrawals to easy online payment tools, our solutions empower homeowners to take control of their finances effortlessly.

Flexible Payment Options

Autodraft (ACH)

Payments are withdrawn directly from your bank account. Bi-weekly, semi-monthly, and monthly options are available.

One-Time Payment

Pay when it's convenient for you. Sign in to your online account to make a hassle-free payment.

Online Bill-Pay

Set up payments through your bank's online-bill service—or any other online bill-pay system.

Alternative Plans

Check or Money Order is a simple and reliable way to send your payment.

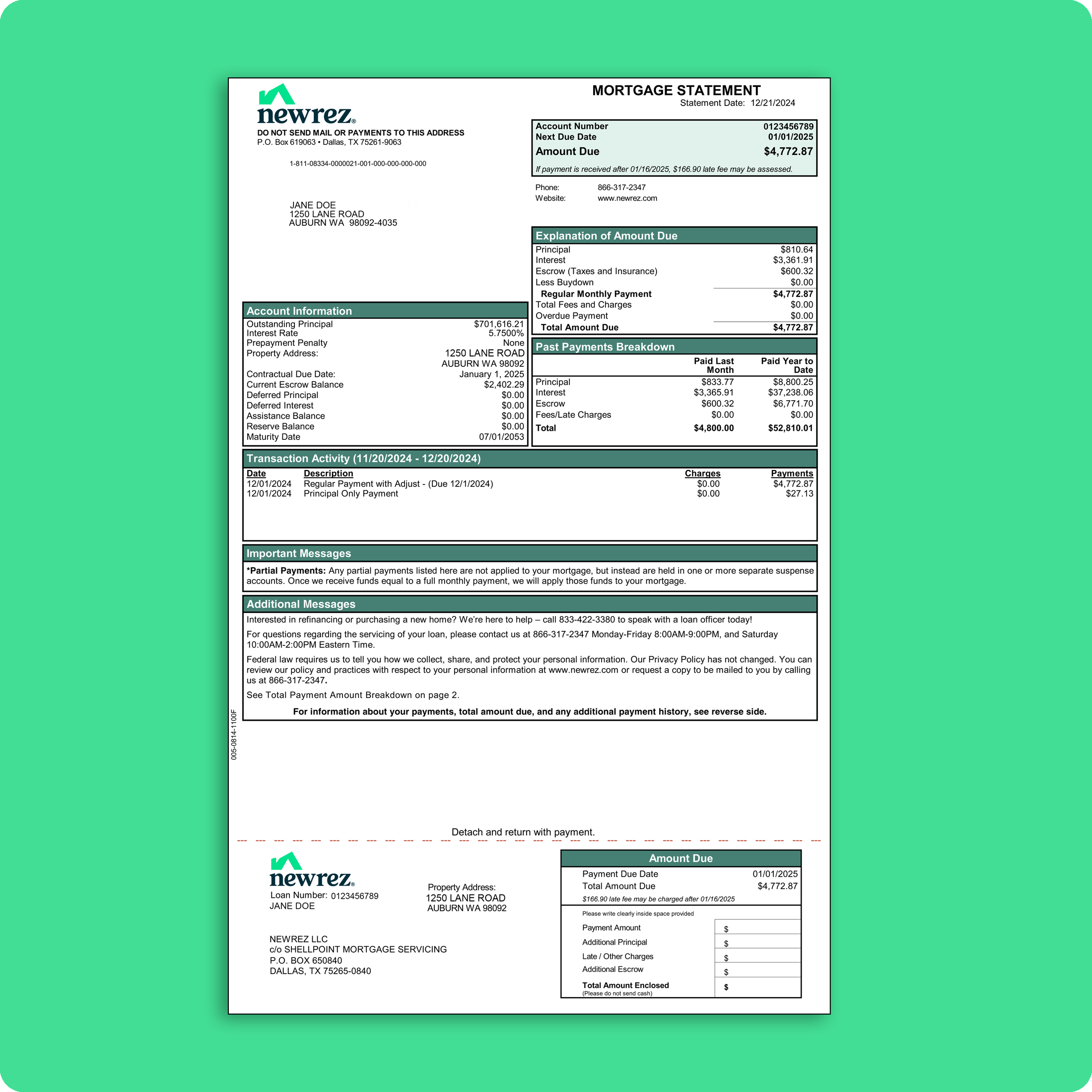

Questions about your mortgage statement?

Check out this quick breakdown of how to read your mortgage statement.

Benefits of Flexible Mortgage Payments:

Minimize Stress

Set up your payments to fit your financial schedule.

Avoid Late Fees

Automatic reminders and withdrawals ensure timely payments.

Financial Management

Simplify budgeting with consistent mortgage payment structures.

More Convenience

Access payment tools anytime, anywhere with online solutions.

FAQs

Sign in to your online account and click Account Details to access your dashboard. Hover over Payments and then choose View Pending Payments. It may take up to three business days for funds to be withdrawn from your bank account.

If you want us to alert you when we withdraw your payment from your bank account and post it to your mortgage account, sign up for text notifications. From your dashboard, click on the “down” arrow next to your profile icon and select “My Profile” from the drop-down menu. Then, navigate to “Phone Numbers” in the top menu. Verify your phone number and phone type, check the box to opt-in to text alerts, and click “Save.” If you need to update your phone number, you can call us at 866-317-2347 or chat with us online Monday - Friday, from 8 a.m. - 6 p.m. ET.

Nothing. Your previous servicer will forward your payment to us.

If you want us to alert you when we withdraw your payment from your bank account and post it to your mortgage account, sign up for text notifications. Sign in to your online account and click Account Details to access your dashboard. Click on the “down” arrow next to your profile icon and choose “My Profile” from the drop-down menu Then, navigate to “Phone Numbers” in the top menu. Verify your phone number and phone type, check the box to opt-in to text alerts, and click “Save.” If you need to update your phone number, you can call us at 866-317-2347 or chat with us online Monday - Friday, from 8 a.m. - 6 p.m. ET.

It could mean we need to speak with you regarding your loan.

Have your loan number ready and call 866-317-2347 to speak with one of our representatives. We’re available Monday - Friday from 8 a.m. to 9 p.m. ET and on Saturday from 10 a.m. - 2 p.m. ET. You can also use our chat function by signing into your online account and click Chat Online from your dashboard, Monday - Friday, from 8 a.m. - 6:00 p.m. ET.

Whether or not you can cancel an already scheduled payment depends on what kind of payment it is:

- Same-day payments cannot be canceled. This includes one-time payments that you scheduled earlier in the day or any payment that’s scheduled to be paid that same day.

- Monthly or bi-weekly autodraft payments can be canceled — as long as you make your request no less than three business days before the scheduled payment date. Have your loan number ready and call 866-317-2347 Monday – Friday 8 a.m. – 9 p.m. and Saturday 10 a.m. – 2 p.m. ET.

- For any other scheduled payments:

- If it's more than seven business days befoer your scheudled payment date, you can cancel your payment. Sign in to your online account and click Account Details to access your dashboard. Hover over Payments and choose View Pending Payments.

- If it's seven business days or less before your scheduled payment date, have your loan number ready and call 866-317-2347 Monday - Friday 8 a.m. - 9 p.m. and Saturday 10 a.m. - 2 p.m. ET. Tell the representative you want to cancel a schedule payment.

Most changes in your payment amount are due to changes in your property taxes or your homeowner’s insurance premiums. If you have an adjustable-rate mortgage, your payment may have changed as a result of us recalculating your interest rate.

Are you interested in paying off your mortgage loan? Sign in to your online account and click on Account Details to access your dashboard. Hover over Payments and then choose Request Payoff to request a payoff quote.

Your quote will have an expiration date, so act quickly after you receive it. Otherwise, it will expire, and you’ll have to start over and get another one.

Sign in to your online account and click Account Details to access your dashboard. Select Make a One Time Payment and click the Continue button. Click the Edit button, which displays your bank-account information, along with two data-entry fields: one for Additional Principal payments and the other Additional Escrow payments.

Choose the appropriate checkbox and then enter the amount you want to pay in the corresponding data field. Verify your bank account information and click Continue. Then, verify the displayed transaction details and click Save.

To make a fee payment, call 866-317-2347 and ask to speak with one of our representatives during our office hours of 8 a.m. to 9 p.m. Monday - Friday and on Saturday from 10 a.m. - 2 p.m ET.

You can also mail us a check or money order. Be sure to include a detailed letter that explains what fees you want to pay. Be sure to write your loan number on your check or money order. Mail your payment and your letter to:

Newrez

PO Box 60535

City of Industry, CA 91716-0535