Escrow Hub

Your guide to escrow accounts and why they matter.

What You Need to Know About Escrow

As a homeowner, understanding how your escrow account works is essential, and we're here to help.

Escrow Essentials: What Every Homeowner Should Know

Watch our most recent escrow webinar hosted on November 12, 2025. Our experts shared an exclusive deep dive into the world of escrow - what it is, why it matters, and how it's evolving to better serve you.

A loan-servicing escrow account is an account that we maintain to pay your taxes and homeowners insurance on your behalf, using funds set aside from your monthly mortgage payments. This means you don’t have to worry about paying these bills directly—we handle making the payments for you!

It’s important to note that the amount you contribute to your escrow account may change over time, depending on adjustments to your property taxes or insurance premiums.

Questions about your escrow analysis?

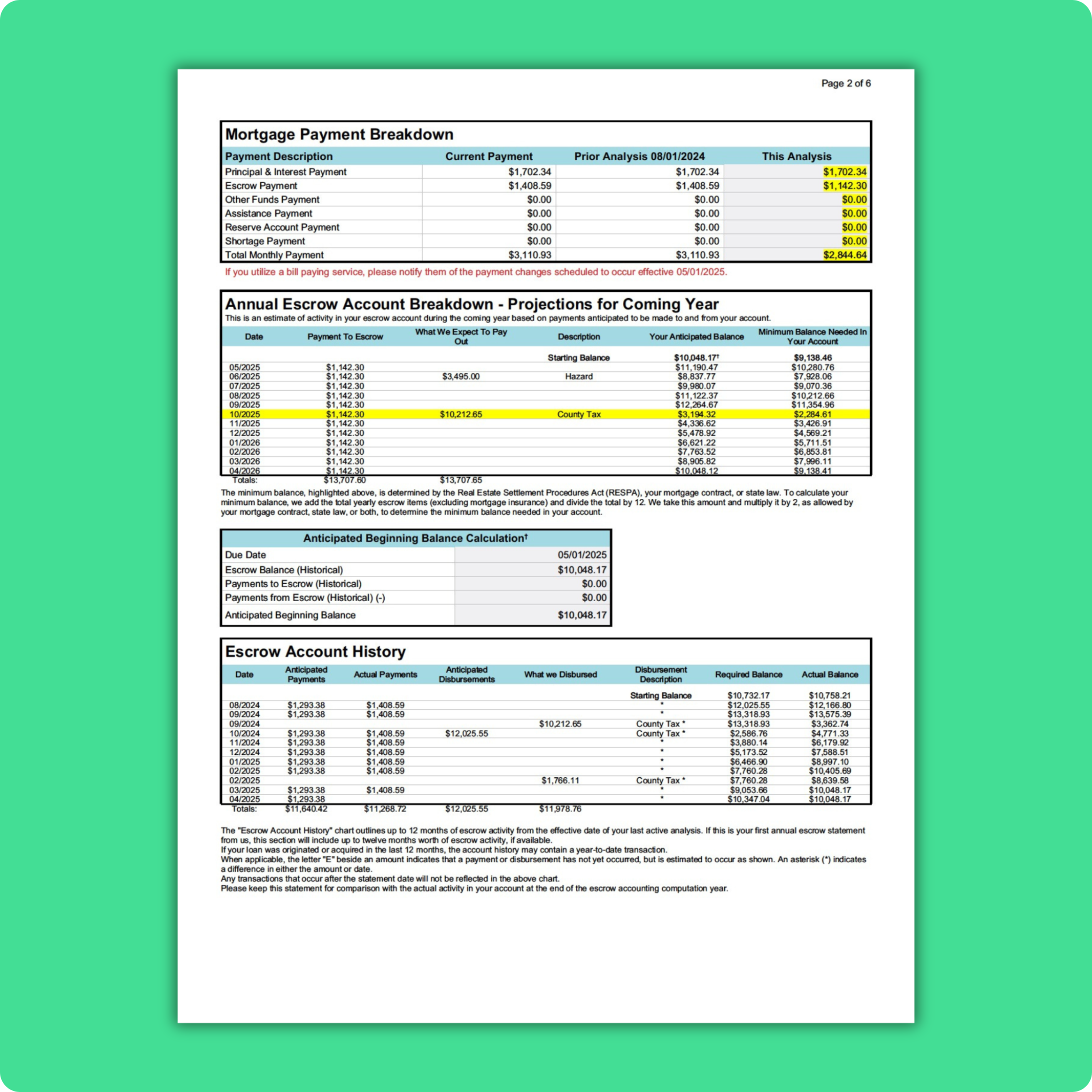

Check out this quick breakdown of how to read your escrow analysis.

Benefits of an Escrow Account

Hassle-Free Billing

Costs associated with tax and insurance bills are included in your regular mortgage payment.

Easy Budgeting

Costs for the year are spread into smaller payments each month.

Financial Convenience

Organizes payments to help you avoid late fees on taxes and insurance.

Annual Analysis

Annual expenses are reviewed and payments are adjusted accordingly.

Frequently Asked Questions

Requests for analysis outside of the annual schedule will typically fulfilled within 21 days. For analysis provided on an annual basis, the delivery timeframe will depend on the current conditions of your loan.

We analyze your escrow at least annually. After completing our analysis, we mail you a detailed letter explaining the results and any change in your mortgage payment along with a personalized video (if we have your email on file) explaining the results.

Need a quick breakdown of how to read your escrow analysis? Check out our detailed explanation.

If you have an escrow surplus, we include your surplus check in the same envelope as your escrow analysis letter unless state requirements dictate otherwise. Learn more about escrow refunds in our article.

The cushion is used to offset any potential shortages an escrow account may incur due to the increases in property taxes or homeowner's insurance in the upcoming 12 months. To learn more, read about cushions in our What is Escrow? article.

If you suspect an issue—such as a tax or insurance bill not being paid—contact us. We’ll work closely with you to resolve it. You can also send us a secure email through your online account. Sign in to your online account and click Account Details to access your dashboard. On the right side of your dashboard, click Contact Us. Choose Escrow Payment or Analysis in “What is your question about?” and select an option that best fits your request. Add details and click Submit.

Insurance: Your insurance premium is determined annually by your provider. You can request a new quote from another provider or contact your insurer to discuss the increase.

Taxes: Your local government calculates taxes based on your property’s assessed value and tax rate. Contact your local tax authority for more information.

Most changes in your payment amount are due to changes in your property taxes or your homeowner’s insurance premiums. If you have an adjustable-rate mortgage, your payment may have changed as a result of us recalculating your interest rate. Learn more in this article.

Yes. Sign in to your online account, click Account Details to access your dashboard, then choose Escrow and select Escrow Statement to view your current escrow statement.

Sign in to your online account, click Account Details to access your dashboard. Hover over Escrow to view your escrow overview, accounts, disbursements, statements, and analysis.

Possibly. Only 15 states require interest to be paid on escrow accounts (e.g., California, New York, Massachusetts). Rules vary, so consult your financial advisor or attorney for details relevant to your state.

Property taxes may be tax deductible. However, only the actual taxes we paid on your behalf—not the amount deposited into escrow—may be able to be deducted. Consult your tax advisor for guidance.

Possibly. You can ask us to remove your escrow account either verbally or in writing.

To make your request online, Sign in to your online account and click Account Details to access your dashboard. On the right side of your dashboard, click Contact Us. and choose Escrow Payment and Analysis from the available options under “What is your question about?” Next, select More Specifically and choose Requesting for my escrow account to be deleted. In the Details field, provide a detailed description of why you want us to remove your escrow account and click Submit.

We’ll review your request in conjunction with your mortgage agreement and all applicable regulations, and we’ll respond to you within 30 days. Note: For some loans, an escrow account is required and cannot be removed. Learn more in our escrow article.

Sign in to your online account and click Account Details to access your dashboard. Hover over Payments and click Payment History to view all transactions. Your insurance payment is a line item that says “Insurance Premium Disbursement” in the Description column. The “Escrow Amount” field to the right shows how much we paid out of your escrow account.

Sign in to your online account and click Account Details to access your dashboard. Hover over Statements and click Taxes & Insurance. The insurance amount shown is an estimate based on what we paid for you last year. We won’t know the exact amount we need to pay until we get your latest bill.

Probably not. If your loan has an escrow account, you do not need to send us the bill. We receive an electronic version of your bill, and we pay it for you—before the due date.

The only exception is if you get a delinquent, corrected, or supplemental tax bill. We’ll also pay that bill from your escrow account, but you need to send us a copy of it. Either scan the bill or take a good-quality photo and upload it through the Contact Us page in your online account. Sign in to your online account and click Account Details to access your dashboard. On the right side of your dashboard, click Contact Us and choose Escrow Payment or Analysis from the available options under “What is your question about?” In the Details field, provide a detailed description of the tax bill you received. Then click on the Choose file button to upload a scanned copy or a photo of the tax bill. After you select the document file, click on the Submit button.

Note: If your mortgage does not have an escrow account, you must pay all tax bills yourself.

Sign in to your online account and click Account Details to access your dashboard. Hover over Payments and choose Payment History. Your tax payment is a line item that includes the words “Tax Bill” in the Description column. The “Transaction Amount” field shows the amount we paid.

Sign in to your online account and click Account Details to access your dashboard.

Hover over Statements and choose Taxes and Insurance. The tax amounts shown are estimates based on what we paid for you last year. We won’t know the exact amount we need to pay until we get your latest bill.

Sign in to your online account and click Account Details to access your dashboard. Hover over Statements and choose 1098 Yearly to view or download your most recent Forms 1098.

Federal law requires us to complete and send your Mortgage Interest Statement (Form 1098) for a given year by January 31 of the next year. After we mail your statement, we post it on our website so you can view and print it at your convenience. Note: If you’ve opted to receive only digital statements, we will not mail you a paper copy.

To be notified when your Form 1098 is available, you can sign up for text notifications. From your dashboard, click on the “down” arrow next to your profile icon and select My Profile from the drop-down menu. Then, navigate to “Phone Numbers” in the top menu. Verify your phone number and phone type, check the box to opt-in to text alerts, and click Save. If you need to update your phone number, you can call us at 866-317-2347 or chat with us online Monday - Friday, from 8 a.m. - 8 p.m. ET.

No. With only a few exceptions, you must pay supplemental tax bills yourself.

Your Tax ID number is the same as your Social Security number. If you don’t have a Social Security number, call our Customer Care Team at 866-317-2347.