Need extra cash for a big purchase or a home renovation? Credit cards may be convenient for everyday buys, but homeowners have a powerful alternative: a Home Equity Line of Credit (HELOC).

At Newrez, we want to equip you with the tools and knowledge to reach your financial and homeownership goals. In this article we’ll break down how credit cards and HELOCs stack up so you can choose the option that best fits your needs.

How a HELOC Works

A Newrez Home Equity Line of Credit is a revolving line of credit secured by the equity you’ve built up in your home. A HELOC has two phases:

- Draw Period: You can borrow money up to your approved line amount for the first 3 years of your HELOC. During these 3 years, you only pay interest on your Newrez HELOC.

- Repayment Period: You are not allowed to make any more draws during the following 17 years of your Newrez HELOC. During this period you are repaying the principal amount you used with interest.

The interest rate of a HELOC is based on the Prime Rate published daily in the Wall Street Journal®.

How a Credit Card Works

Even if you have a credit card in your wallet right now, you might not be entirely familiar with how they work. Credit cards are unsecured revolving lines of credit with no defined draw or repayment periods.

- You borrow day to day, up to your credit limit.

- You typically get a grace period of 21 days or more to pay the full balance before interest accrues.

- Past the grace period, interest accrues on your balance.

Credit cards may be convenient for everyday purchases and sometimes offer rewards for their use, but if you don’t pay them off on time your debt may quickly accumulate. It’s a good idea to keep track of your spending when you use a credit card so your bills don’t stack up unexpectedly.

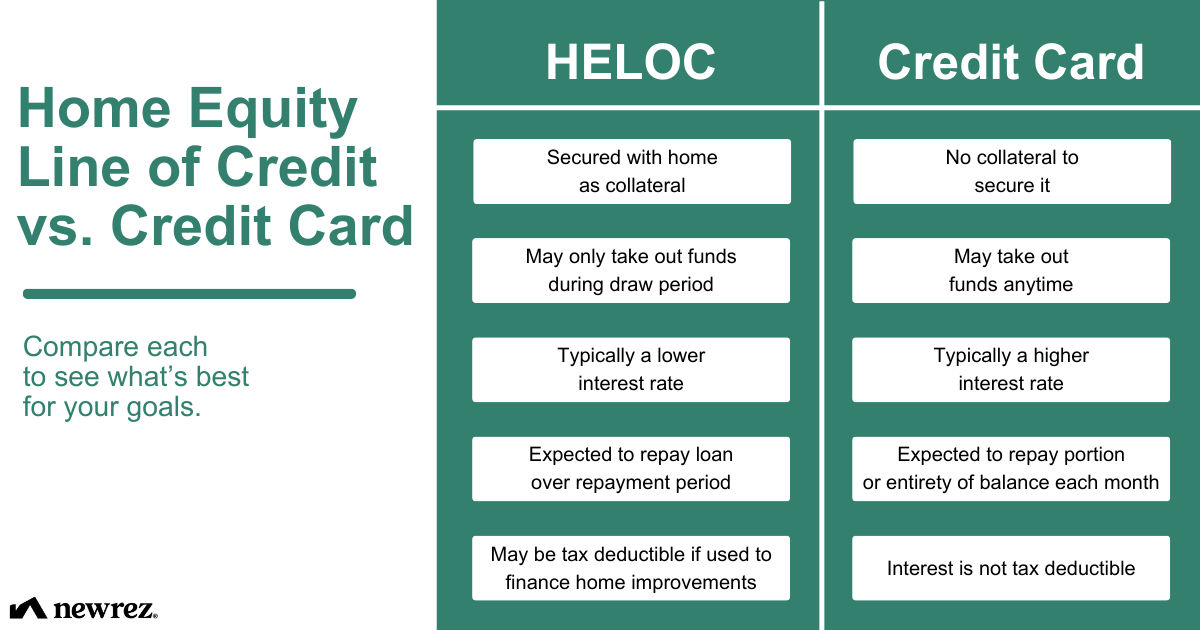

Click image below to enlarge.

Credit Card Interest Rates vs. HELOC Interest Rates

In the third quarter of 2025, credit card accounts that were assessed interest paid an average of 22.83% in interest, according to the Federal Reserve.1 Newrez HELOC rates were less than half that during the same period.

When to Use a HELOC

HELOCs give qualified homeowners a flexible spending tool that can empower them to pay for unpredictable expenses whenever they need, during their draw period. A few popular ways to use a HELOC include:

- Funding Major Home Renovations: Is your kitchen a bit outdated? Have you been dreaming of a beautiful backyard oasis? Opening a HELOC may enable you to fund each step of a renovation easily.

- Strategic Debt Consolidation: Pay off higher-interest debt—which may include credit card debt—by consolidating your debt into your HELOC. This strategy could potentially help you save on interest. Once you’ve done this, put a financial plan in place so you don’t recharge those credit cards afterwards.

- Planned Big-Ticket Expenses: Use a HELOC to cover tuition, medical procedures or wedding costs.

The Bottom Line

You may use credit cards for day-to-day spending, but if you’re a homeowner with some equity built up, don’t discount the power of a HELOC to help with larger expenses. Your equity might earn you access to low-interest funding, which could be great news for your bank account.

Have questions about what your home’s equity can do for you? Reach out to a Newrez mortgage expert today, and they’d be happy to walk you through your options.

References:

1 Federal Reserve Board - Consumer Credit - G.19