On Wednesday, June 18, the Federal Open Market Committee (FOMC) voted to keep the federal funds rate steady, indicating in a statement that economic activity is growing at a “solid pace.”1 This is the third meeting in a row at which the FOMC has decided to keep the federal funds rate steady, taking a wait-and-see approach to inflation and economic policy.

What could this mean for hopeful homebuyers? No one can say for certain, but we’ve provided this guide to help you understand what the Fed’s latest decision means and how it could possibly impact mortgage rates.

What Does the FOMC Do?

The mandate of the FOMC is twofold:

- To promote maximum employment

- To keep prices steady throughout the economy

The Fed attempts to influence inflation and employment via monetary policy, and by making changes to the federal funds rate.

What Is the Federal Funds Rate?

The federal funds rate is the rate at which banks borrow money from each other overnight. This in turn affects the cost of borrowing money across the economy.

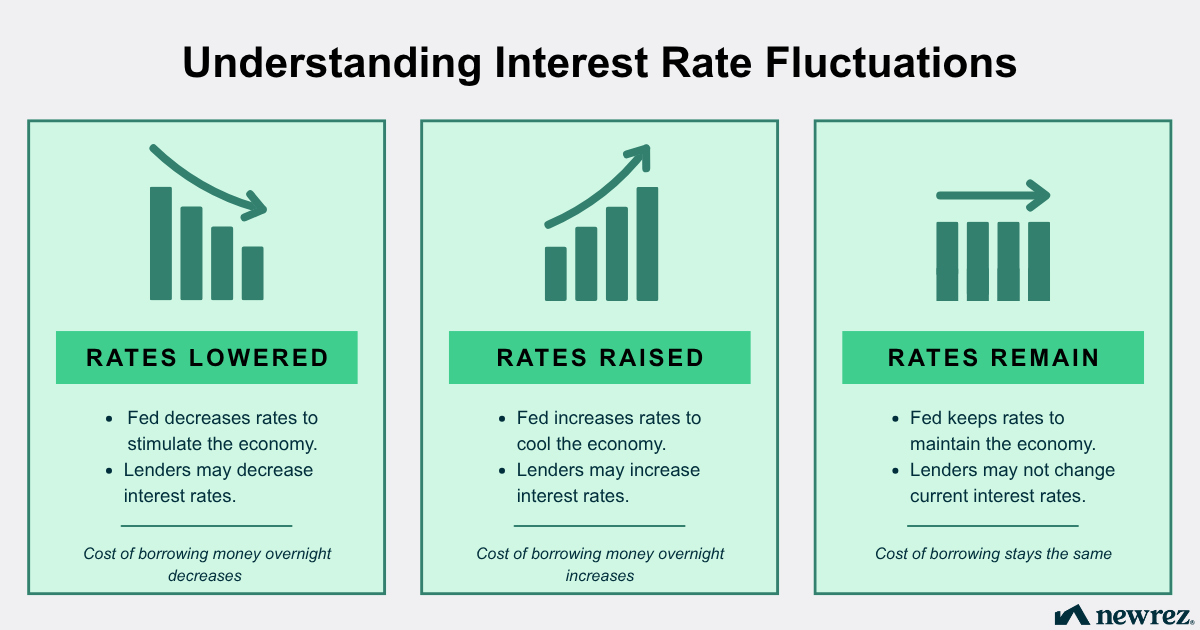

Click image below to enlarge.

- If the Fed increases the target range of the federal funds rate, it results in a “tightening” of monetary policy, making it more costly to borrow money. Banks often pass this cost onto consumers by increasing interest rates on loans.

- If the Fed decreases the federal funds rate, this “loosening” of monetary policy makes it cheaper to borrow money. This allows banks and other financial institutions to lower rates.

Key Economic Metrics the Fed Watches

To make their decisions, the FOMC keeps a close eye on:

Inflation: At the latest reading as of June 11, inflation rose 2.4% year-over-year in May, only increasing slightly month-over-month from April’s 2.3% reading per the Bureau of Labor Statistics.2 Core inflation, or inflation minus the more volatile categories of food and electricity, hit 2.8% year-over-year.

This is the first reading of inflationary data gathered after major trade tariffs were imposed on most of America’s trade partners, and it’s a hopeful sign that prices held relatively steady since then.

Labor Market: As of the latest reading on June 6, unemployment as remained unchanged at 4.2%, with job gains in healthcare, hospitality and social services and losses in federal government jobs.

The overall steady pace of employment is a good sign for the economy, as well as for the housing market. After all, higher employment means that more people could have the financial ability to buy a home.

How Might This Change Impact Mortgages?

The federal funds rate only has an indirect impact on mortgage rates. Since the federal funds rate is the rate at which banks borrow money overnight, it has a more direct impact on short-term interest rates.

Mortgages, which commonly last 15 or 30 years, are more directly impacted by the 10-year treasury bond yield. But a number of economic indicators can hold sway over mortgage rates. Learn more about what influences mortgage rates.

Should I Buy a Home?

If you’re waiting for rates to fall before pulling the trigger on a home purchase, you may be waiting longer than you expect. Though it’s wise to keep an eye on the economy and interest rates while buying a home, no one can accurately predict what how rates might move next. Ultimately, your own goals and financial circumstances should be your largest deciding factors in purchasing a home.

If you’re hoping to lock in an interest rate while you house hunt, our Lock & Shop*** perk allows you to keep a rate locked for 45 days.

References:

1 Federal Reserve Board - Federal Reserve issues FOMC statement