Buying a home with a small down payment is possible through two of the most popular conventional loan programs: HomeReady® by Fannie Mae® and Home Possible® by Freddie Mac®. These programs are designed to expand homeownership opportunities while keeping costs accessible.

At Newrez, we believe in providing opportunities to as many hopeful homeowners as possible—including borrowers who don’t have much money saved up for a down payment. Below, we provide a detailed comparison, eligibility requirements, and how these loans stack up against FHA and USDA options.

What Are HomeReady® and Home Possible® Loans?

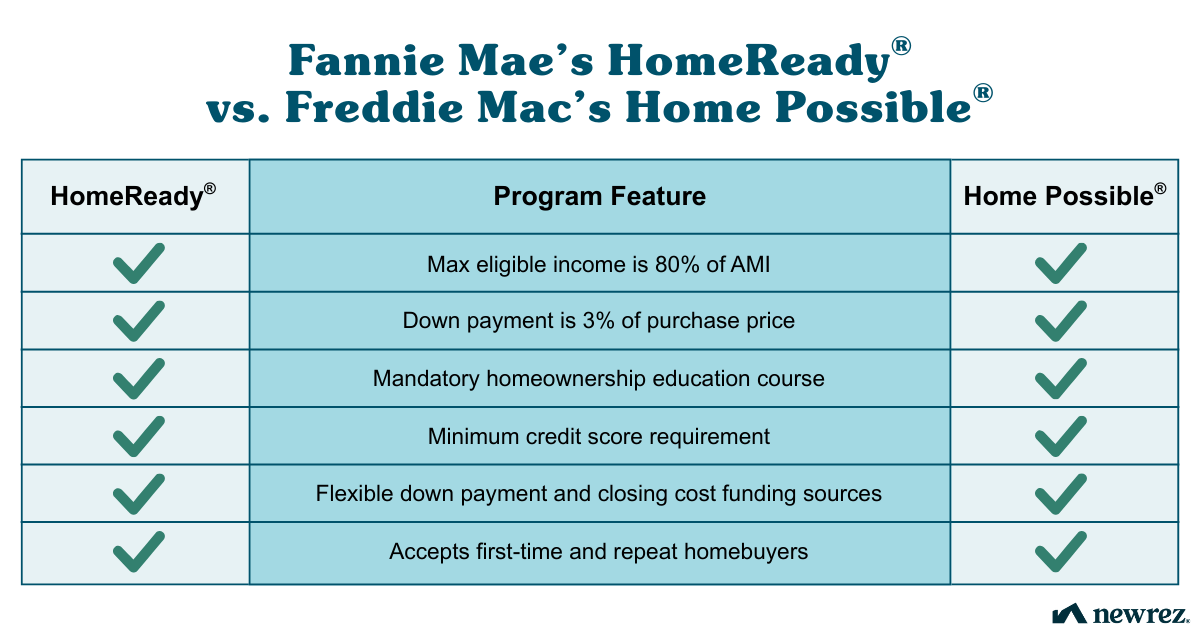

Both HomeReady® (by Fannie Mae®) and Home Possible® (by Freddie Mac®) are conventional loan programs that require as little as 3% down. They could be ideal for first-time and moderate-income homebuyers who may not have significant savings but are financially ready to purchase a home.

Eligibility Requirements for HomeReady®1 and Home Possible®1

Income Limits

- Maximum income: 80% of the Area Median Income (AMI).

- Tools from both Fannie Mae® and Freddie Mac® allow you to check income limit eligibility based on your address.

Loan Limits

For 2025:

- $806,500 in most U.S. counties

- Up to $1,209,750 in designated high-cost areas

Homeownership Counseling

- First-time buyers must complete a homeownership education course online before closing.

Credit Score Requirements

- Home Possible®: minimum 580

- HomeReady®: minimum 580

Key Benefits of HomeReady® and Home Possible®

- Low Down Payment: Eligible borrowers may only need to put 3% down.

- Flexible Funding: Borrowers may be able to make 100% of their down payment and closing costs through gifts, grants or assistance programs.

- Flexible Underwriting: Debt-to-income ratios will depend on the borrower’s overall risk profile.

- No First-Time Buyer Restriction: You can own another property while using the program.

Potential Drawbacks

- Income Cap: Borrowers must meet strict income eligibility, which can exclude higher-earning households in urban areas.

- Loan Size Limits: Jumbo loans are not eligible under these programs.

How HomeReady® and Home Possible® Compare to Other Low-Down-Payment Loans

FHA Loans

- Minimum down payment requirement: 3.5%

- Credit score: As low as 580

- Mortgage insurance: FHA collects a one-time Upfront Mortgage Insurance Premium (UFMIP) and an annual insurance premium.

- PMI cancelation: Not allowed unless refinancing

Note: Lifetime insurance costs may be higher than for HomeReady®/Home Possible®

USDA Loans

- Down payment requirement: 0% (100% financing)

- Income limit: 115% of AMI

- Geographic restriction: Available only in eligible rural and suburban areas

- Fees:

- Guarantee Fee: Paid upfront in cash or financed into the loan

- Annual Fee: Premium paid monthly over the life of the loan

- PMI

Advantage: No down payment required

Disadvantage: Restricted to rural/suburban locations

When to Choose HomeReady® or Home Possible®

- If you want the lowest down payment without being tied to rural locations (vs. USDA).

- If you prefer the option to cancel PMI (vs. FHA).

- If your credit score is 580+ and your income falls within program limits.

Takeaway

HomeReady® by Fannie Mae® and Home Possible® by Freddie Mac® are among the most affordable and flexible loan programs for first-time and moderate-income buyers. For qualified borrowers whose income meets the 80% AMI threshold and who maintain a strong credit profile, either program allows them to buy a home with as little as 3% down and the ability to cancel PMI once equity builds. Compared to FHA and USDA loans, these options balance accessibility, long-term savings, and flexibility across most U.S. markets.

Still not sure which affordable loan option is right for you? Newrez loan experts are ready to walk you through your options. Reach out today for a no-obligation chat.