Home builders are no longer required to get a Builder Identification Number from the Department of Veterans Affairs (VA) in order to sell homes they’ve built to VA-qualified borrowers. This change benefits builders and borrowers, since it eliminates an administrative hurdle that had been imposed on already-licensed builders.

The VA provides loans to qualified Veterans, active-duty service members and surviving spouses looking to achieve home ownership. This latest VA loan change was announced by the Veteran’s Benefits Administration on March 31, 2025. We’ve created this guide to walk VA borrowers and builders through what this means for them.

Understanding the Former Builder Identification Number Requirement

Before March 31, 2025, the Lender’s Handbook issued by the VA stated that builders were required to get a BIN in every state where they build VA-qualified homes. The BIN had to be issued before a Notice of Value (NOV) could be issued. This sometimes delayed underwriting and closing timelines. Not to mention, most states already require builders to be licensed, so this requirement only created more paperwork for builders.

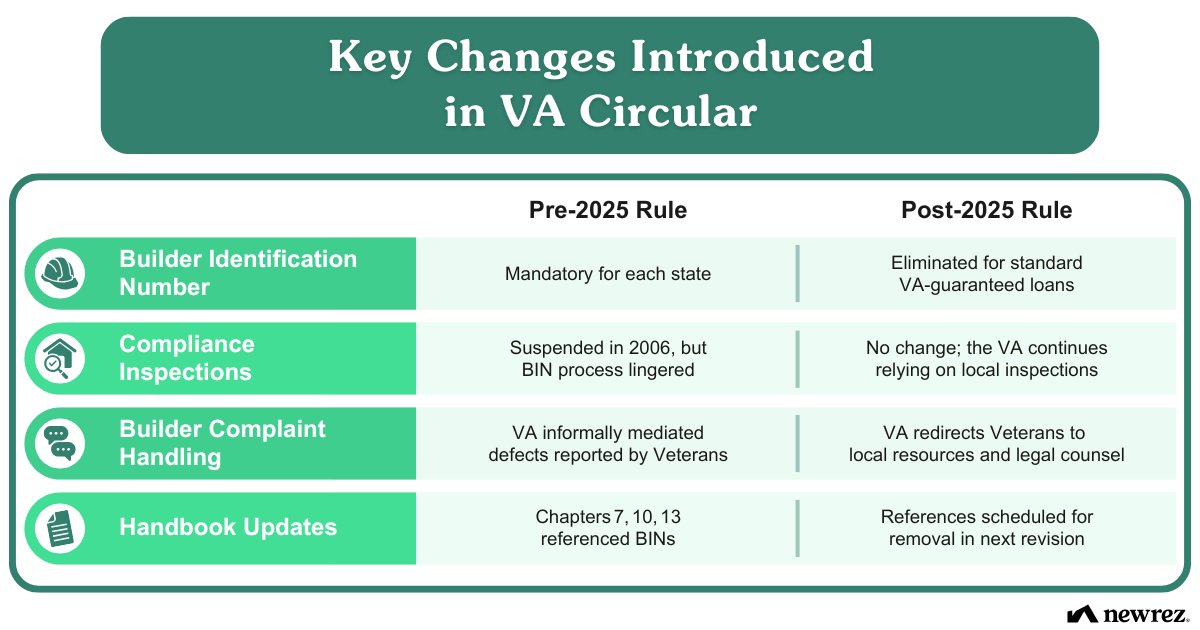

Key Changes Introduced in March 2025

Click on the graphic below to enlarge.

Exceptions to the Rule Change

Two programs still carry the BIN requirement for builders:

- Specially Adapted Housing (SAH) Grants: These grants, designed for Veterans with service-related disabilities, require more oversight from the VA.

- Native American Direct Loan (NADL) Program: Tribal trust land construction will still necessitate BINs to track builder eligibility.

VA Builder Complaint Resolution

The VA stated in their March announcement that complaints about home builders will no longer be handled by the VA, but by local authorities and legal avenues.

How Veterans Can Protect Their Interests Under the New Rules

Before you ever have the need to file a complaint about a builder, it’s a good idea to check permits for yourself and keep a record of everything in case you need to reference it later.

- Vet Builder Credentials: Verify state license numbers, look at reviews and check disciplinary records.

- Request Written Warranties: Insist on clarity when it comes to what items are covered and for how long.

- Schedule Third-Party Inspections: Engage independent inspectors before closing.

- Document Everything: Maintain dated photographs and keep a record of correspondence.

Your Questions, Answered

Does eliminating the BIN reduce consumer protection?

No. State licensing boards and local code enforcement still act as safeguards, and mandatory warranties still protect Veterans.

Will legacy loans with BINs be affected?

Existing loans remain valid. Complaints filed within the original 1-year warranty window will still follow prior VA assistance rules.

Newrez Supports Veterans and Active Military

At Newrez, supporting the Military is at the core of who we are as a company. Our mortgage experts are here to answer your VA loan questions and find you a loan that fits your needs. Ready to speak with an expert? Reach out to us today.

Source: Circular 26-25-1