We believe it’s important for our borrowers to be able to make informed decisions when it comes to their homeownership goals. Though no one can say for certain how the forces of the economy will impact mortgages, we’ve collected insights from some industry experts on what could be in store in the next year or so.

Mortgage Demand

Mortgage originations were down in the first quarter of 2025, according to the Mortgage Bankers Association (MBA®), but originations are expected to tick up considerably in the second quarter, fall seasonally through the end of the year and then bump back up in mid-2026.1

It’s common for home sales to perk up during the spring season, and this is reflected in the MBA® predictions for purchase originations, which are expected to increase mid-year in 2025 and 2026, with a dip in between.1 The MBA® expects a similar pattern for refinance originations through 2026.1

The economists at Fannie Mae® slightly increased their mortgage origination estimations for 2025 upward in March.2

The Housing Market Sees Some Hopeful Signs

In addition to the seasonal spring buying boost, a couple other signs are giving the housing market some tailwinds:

- Sale Price: The median sales price for new and existing homes fell in the fourth quarter of 2024 and stayed fairly steady in the first quarter of 2025, per the MBA’s April report, and home prices in 2025 are expected to stay comparable to 2024 prices.1

- For-Sale Inventory: More homes were listed for sale in February, according to the National Association of Realtors®, partly due to increased inventory.3

- Demand Forecast: MBA® is projecting the sale of homes will increase steadily through 2025 and most of 2026,1 and Fannie Mae® has also slightly increased their expectations for home sales in 2025 to 4.95 million homes.2

The housing market isn’t without challenges, however:

- Employment: The jobs market stayed strong in the first quarter of the year, with employment increasing by 228,000 jobs in March, per the Bureau of Labor Statistics.4 The MBA® is projecting increases in unemployment in the coming months, now anticipating 5% unemployment toward the close of 2025.5 Less employment typically means more people aren’t in a financial situation where they want to buy a home.

- New Housing Supply: Single-family building permits in March 2025 are about the same as where they were in March 2024, according to U.S. Census data, while housing starts have just slightly increased from a year ago.6 This won’t be enough to make up for the country’s yearslong housing shortage.7

Keep in mind that the performance of the housing market is always subject to change, and can be influenced by factors such as global trade, government policy, unexpected events and more.

Interest Rates Are Unpredictable

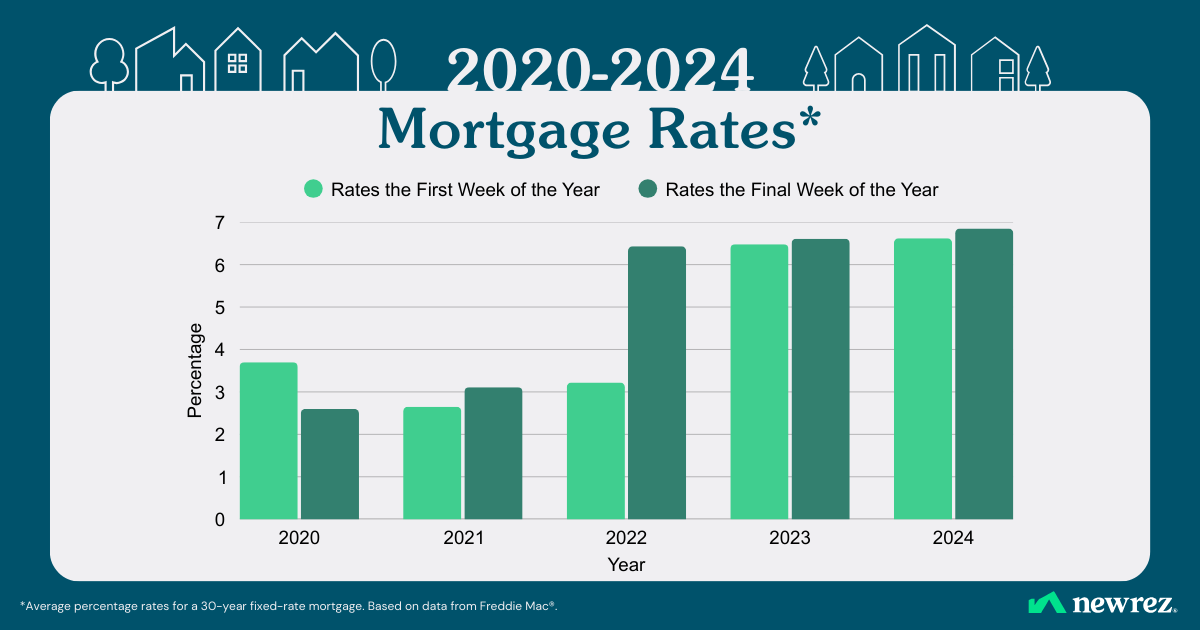

Interest rates have seen a great deal of fluctuation in recent years, from remarkable lows in 2020 and 2021 to spiking sharply in mid-2022. There are various reasons for this, but post-pandemic inflation is a major one.8

Mortgage interest rates are influenced by various economic factors, but they have historically maintained a close relationship with the 10-year treasury yield. To learn more about this relationship and other factors that can impact mortgage rates, read this article.

As we write this in mid-April, concerns about tariffs have helped to push the 10-year treasury lower.9 This could mean that mortgage rates may follow suit, but there’s no guarantee.

This could be welcome news for home buyers. As of March, Fannie Mae® had already revised their expectations downward for mortgage rates, setting them at a projected 6.3% by years’ end and then 6.2% by the close of 2026, which might encourage more activity in the housing market.2

The Bottom Line

Despite the affordability difficulties the housing market has experienced in recent years, there are some signs that could signal increased home sales in the coming months. Home buyers might be encouraged by the possibility of tempering home prices and cooled rate growth.

The movement of the market is unpredictable. Ultimately, your decision to buy or sell a home should be based largely on your own goals and needs. In certain conditions, homeownership could be a pathway to building wealth.

Looking for a mortgage expert to walk you through your options? Reach out to us.

MBA® is a registered trademark of the Mortgage Bankers Association. Fannie Mae® is a registered trademark of the Federal National Mortgage Association. National Association of Realtors® is a registered trademark of the National Association of Realtors. Freddie Mac® is a registered trademark of the Federal Home Loan Mortgage Corporation. None of the above-mentioned companies are affiliated with Newrez LLC.

References:

1 {9902d121-9a52-45e3-825c-7f43214fb5d7}_Mortgage_Finance_Forecast_Apr_2025.pdf

2 Economic Developments - March 2025 | Fannie Mae

3 Residential Real Estate Market Snapshot

4 Current Employment Statistics - CES (National) : U.S. Bureau of Labor Statistics

5 {d149271d-8c99-4146-bd93-4b9148bb160d}_Economic_Forecast_Apr_2025.pdf

6 New Residential Construction Press Release

7 America’s housing shortage by the numbers

Graphic Mortgage Rates - Freddie Mac