If you like the idea of living in a multi-unit community with shared maintenance and amenities, you may enjoy living in a condo or a co-op. And while these two home types may appear similar, the structure of ownership, financing, resale potential and governing rules differ dramatically.

At Newrez, we aim to offer guidance to borrowers in a broad range of circumstances. Read this article to learn the ins and outs of condos and co-ops to make the right choice for you.

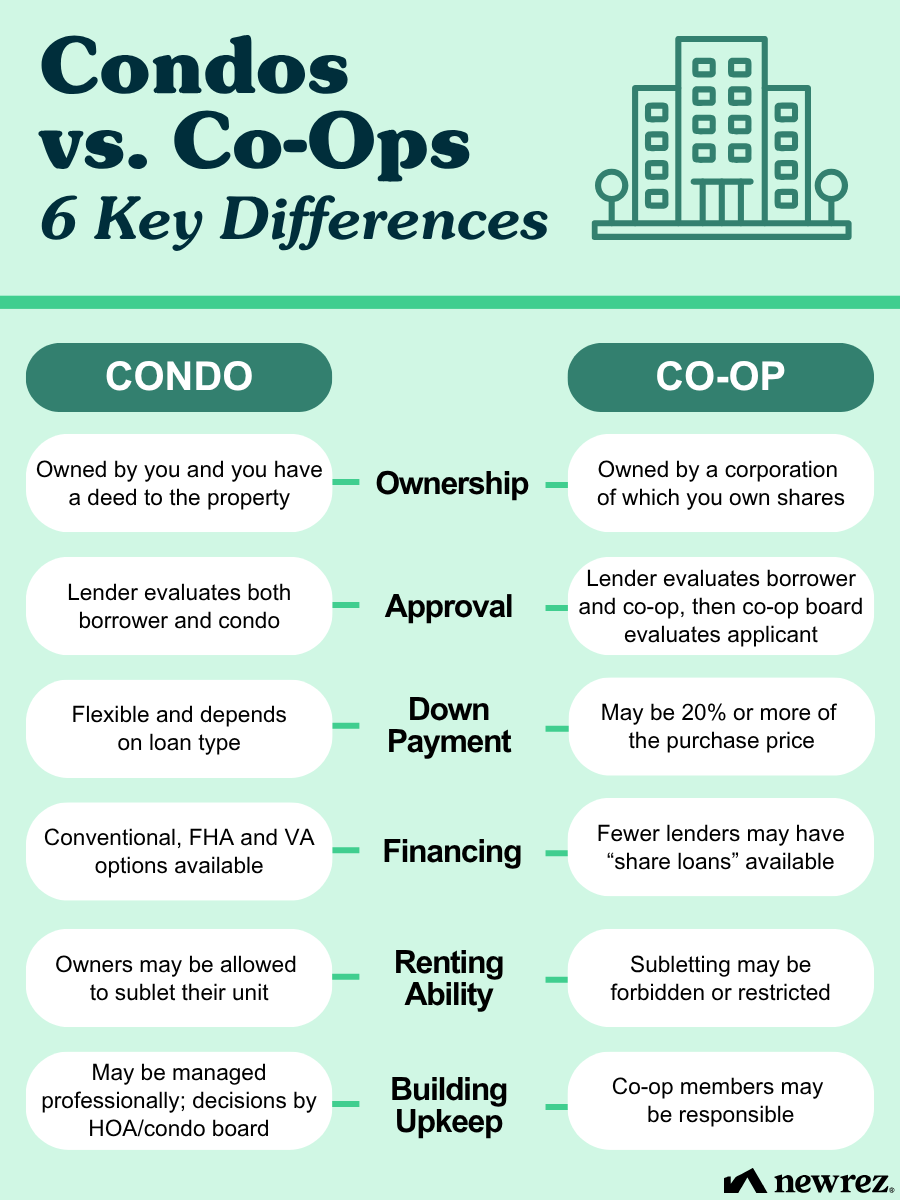

Ownership Structure: Deeds vs. Shares

Condo: You own a physical unit and a percentage of shared common areas. You hold a deed, just as with a traditional single-family home.

Co-Op: You don’t own physical property, but you own shares in a corporation that owns the entire building. These shares entitle you to a lease, granting the right to occupy a specific unit.

Application and Approval Process

Condo: Buying a condo is a more standard real estate transaction, since you’re buying actual property—the main difference is that your condo will also be evaluated for approval. There’s not usually a personal interview required. Your lender will approve you for a loan based on evaluation of your credit score, income and assets, and will also review the condo’s financials, insurance, operation and any ongoing litigation.

Co-Op: Your lender will evaluate both you and the co-op. In addition, you’ll be required to apply to the co-op board. The board typically vets potential residents very carefully, looking over detailed financial information and often conducting interviews before issuing approval or denial. The board has the right to deny your application even if you meet financial requirements.

Financing Options

Condo: You can get a mortgage that’s backed by your unit as collateral. You may be able to qualify for a government loan, such as a Federal Housing Administration® or Veterans Affairs (VA) loan, and conventional loan options may also be available to you. You may be able to put as little as 3% down, if you qualify.

Co-Op: Because you’re purchasing shares and not real property, you may encounter fewer lenders offering co-op loans (often referred to as “share loans”). Lenders who do offer these loans will likely want to evaluate the co-op and the underlying mortgage. The co-op board may require buyers to put down 20% or more.

Looking for financing for a condo or co-op? Newrez offers products to suit your needs. Call a Newrez mortgage expert today.

Market Value and Equity Growth

Condo: When purchasing, a condo will be appraised in the way a single-family home would, based on its condition, location, and comparable sales. Since it’s owned outright, it can be sold at market price without intervention by a board.

Co-Op: It depends which sort of co-op you settle into. If you move into a market-rate co-op, you’ll usually be able to sell your shares at market rate so long as the board approves your buyer. But if you move into a limited equity co-op, the resale value may be capped to maintain affordability.

Fees and Property Taxes: What You Really Pay

Condo: In addition to your mortgage payment, each month you pay dues to the Homeowners Association (HOA) which cover shared maintenance, amenities and reserves. (Learn more about condo fees here). At closing you’ll typically pay standard closing fees such as title insurance and the cost of appraisal and inspection. You’ll pay property taxes directly.

Co-Op: On top of your monthly loan payments, you’ll usually pay maintenance fees that cover utilities, building insurance and property taxes—so you likely won’t pay property taxes separately. Fees might be higher for co-ops than condos, but they may also cover more, such as utilities and taxes.

Building Management, Governance and Amenities

Condos: A resident-elected HOA (sometimes referred to as a condo association) typically takes responsibility for setting an annual budget, collecting dues and making rules for residents to follow. Resident votes may be held for major decisions. The HOA may hire a professional management company to handle day-to-day operations like maintenance and landscaping.

Co-Ops: A resident-elected board of directors may make decisions similar to a condo HOA, though they are also typically very involved in deciding who is allowed to live within the co-op. Shareholders often get a say in decisions related to the co-op, and smaller co-ops may expect all residents to pitch in on responsibilities such as maintenance.

Both co-ops and condos often offer amenities that may include gyms, pools, laundry rooms, rooftop decks, shared lounges and more.

Availability by Location

Condos: More widely available across urban, suburban and rural markets.

Co-Ops: Largely concentrated in metropolitan areas such as New York City and Chicago.1

Condo or Co-Op: Which is Right for You?

Deciding which living situation makes the most sense for you may depend partly on where you live—if you don’t live in a major metropolitan area, co-ops may not be available nearby. But if both options are available to you, here’s a quick summary of each:

Condo:

- Own real property with a typical mortgage

- Don’t face board approval to buy or sell

- Potentially more loan options available

Co-Op:

- Own shares in a corporation

- Potential for close-knit community environment

- Limited equity models could provide long-term affordability

Whichever option fits with your homeownership goals, Newrez is here to support you along the way. We’ve got loan products for both condos and co-ops—talk with a mortgage expert to find out more.

References:

Federal Housing Administration® is a registered trademark of the Federal Housing Administration.